Terminally Ill Woman Opens Multiple Credit Cards to Live Fully Before She Dies

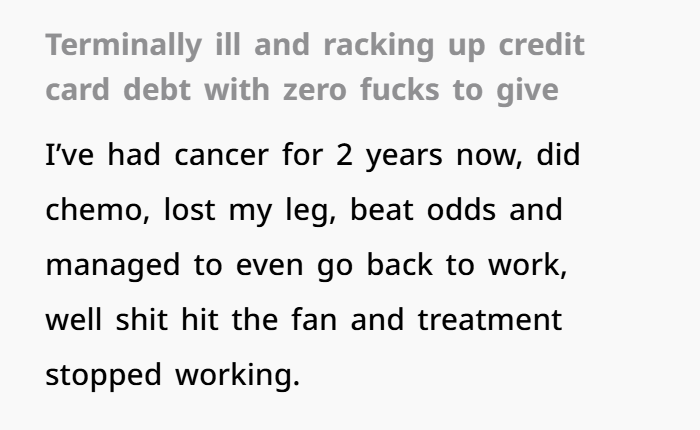

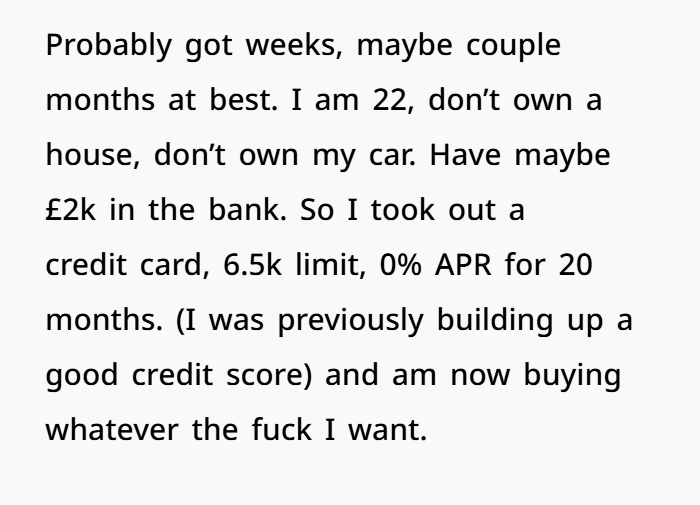

In a poignant testament to autonomy and altruism, a 22-year-old woman facing terminal bone cancer chooses to embrace her remaining days with unbridled generosity. Having endured two years of grueling treatment, including chemotherapy and the loss of a limb, she confronts the cessation of effective medical options. With limited personal assets and a prognosis of mere weeks to live, she secures multiple credit cards, amassing debt to fulfill personal desires and, more importantly, to make meaningful contributions to her loved ones and charitable organizations. Her actions, while unconventional, underscore a profound commitment to leaving a positive impact, challenging societal norms around debt and end-of-life choices.

It would be a devastating shock for anyone to find out that they have cancer

A woman who is terminally ill with bone cancer opened up online about how she’s taking on credit card debt to splurge on everything she wants

The Financial and Emotional Dimensions of Terminal Illness and Debt

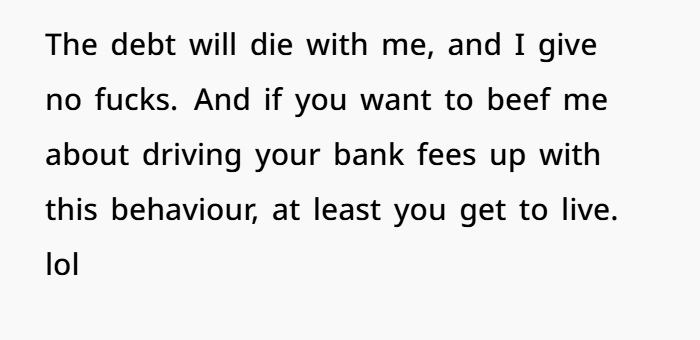

In the poignant narrative shared by a 22-year-old woman facing terminal cancer, we encounter a raw and unfiltered glimpse into the intersection of mortality, financial autonomy, and societal norms. Her decision to accrue credit card debt, fully aware that she will not live to repay it, challenges conventional perceptions of fiscal responsibility and highlights the profound impact of terminal illness on personal choices.

Understanding Debt After Death in the UK

In the United Kingdom, the handling of debts after death is governed by specific legal frameworks. When an individual passes away, their debts do not automatically transfer to family members or loved ones. Instead, any outstanding debts are settled from the deceased’s estate, which includes all their assets at the time of death. If the estate lacks sufficient assets to cover the debts, the remaining balances are typically written off. Creditors cannot pursue family members for these debts unless they were joint account holders or had provided personal guarantees .stepchange.org

In the case of the young woman, her decision to utilize credit cards, knowing she has limited time left, is legally permissible. Since the debts are solely in her name and she has minimal assets, it’s unlikely that creditors will recover the owed amounts after her passing. This legal backdrop provides context to her actions, framing them not as reckless but as a form of personal agency in the face of impending mortality.

The Emotional Landscape of Terminal Illness

Facing a terminal diagnosis at a young age brings forth a complex array of emotions and decisions. The individual’s choice to spend on experiences and gifts for loved ones reflects a desire to create lasting memories and find meaning in her remaining time. This behavior aligns with psychological understandings of how people seek to assert control and leave a legacy when confronted with the end of life.

Moreover, her candidness about not adhering to societal expectations or religious doctrines underscores a personal journey toward authenticity and self-determination. By rejecting imposed narratives and choosing her path, she exemplifies the human need for autonomy, especially when time is finite.

Financial Support for Terminally Ill Individuals

While the individual’s approach is deeply personal, it’s essential to recognize the broader context of financial support available to terminally ill individuals in the UK. Organizations like Macmillan Cancer Support and Marie Curie offer resources, including benefits advice and emotional support, to those navigating the challenges of terminal illness .Macmillan Cancer Support+1Together for Short Lives+1The Guardian+1The Guardian+1

However, recent developments have seen cuts to some of these services. For instance, Macmillan Cancer Support has discontinued its financial hardship scheme, which previously provided grants to low-income cancer patients . This reduction in support highlights the importance of awareness and advocacy for accessible resources for those in need.The Guardian

Ethical Considerations and Societal Implications

The individual’s narrative also prompts reflection on ethical considerations surrounding debt and terminal illness. While her actions are legally sound, they raise questions about the responsibilities of financial institutions and society in supporting those facing end-of-life scenarios. Should there be more compassionate policies or debt forgiveness programs tailored to terminally ill individuals?

Furthermore, her story sheds light on the need for open dialogues about death, financial planning, and personal agency. By sharing her experiences, she challenges taboos and encourages others to consider how they might approach similar situations with empathy and understanding.

The post reached lots of people all over the internet. Here’s what some of them said about the young woman’s situation

Embracing Compassion and Autonomy

The account of this young woman’s final choices serves as a powerful testament to the human spirit’s resilience and the pursuit of meaning in the face of mortality. Her actions, while unconventional, are rooted in a profound desire to live authentically and leave a positive impact on those she cares about.

As society continues to grapple with the complexities of terminal illness and financial responsibility, her story underscores the importance of compassion, autonomy, and the need for supportive structures that honor individual choices at life’s end.