Sibling Rivalry and Inheritance Rights: Do Child-Free Heirs Deserve Less?

In an emotionally charged dispute, a man finds himself at odds with his sister-in-law over his living parents’ estate. As the chosen executor and trustee of a multi-million-dollar legacy, his child-free status becomes the basis of a contentious argument. His sister-in-law, asserting that only those with children can “carry on the family legacy,” insists that his role should be minimized—or removed entirely—despite his qualifications and his parents’ clear wishes. The tension raises complex questions about inheritance fairness, legacy planning, and whether having children should impact one’s worthiness to inherit or manage family wealth.

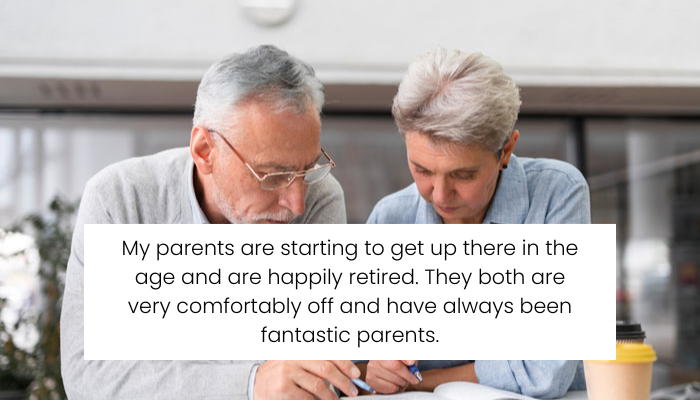

The author of the post is the eldest of two brothers, he’s gay and prefers to stay child-free

The younger brother is straight and married, and they plan to have kids with his wife

Inheritance, Legacy, and the Legal Role of an Executor

When it comes to estate planning, the appointment of an executor—or trustee in the case of a trust—is a legal and logistical decision, not a moral one. Executors are tasked with handling the administrative duties of an estate, including distributing assets according to the will, paying debts and taxes, and managing financial accounts. This role requires trustworthiness, organization, and often a financial background—exactly the traits described in this situation.

According to the American Bar Association, the most important criteria for selecting an executor are dependability, financial acumen, and the ability to act impartially (ABA Source). Choosing someone simply because they plan to have children disregards these key qualifications.

The Myth of Legacy Through Bloodline

The sister-in-law’s argument—that only those with children can carry on a family legacy—stems from a narrow and outdated definition of legacy. Legacy, in modern estate planning, goes beyond bloodline. It includes financial stewardship, preservation of family values, philanthropy, historical documentation, and cultural contributions.

Many trusts and estates attorneys emphasize that leaving a legacy doesn’t solely mean creating a genetic lineage. It also includes preserving wealth, guiding charitable endeavors, protecting real estate or heirlooms, and supporting causes or institutions the family values. To suggest that a person without children is unfit to carry on a family legacy not only ignores these aspects—it’s discriminatory and shortsighted.

Inheritance Law: Equal vs. Equitable Distribution

From a legal standpoint, inheritance laws in most Western countries—including the U.S., U.K., and Canada—grant parents the freedom to distribute assets as they see fit, provided the estate plan is legally valid. “Equitable” does not necessarily mean equal, but it often reflects fairness based on individual circumstances. If parents wish to divide assets equally between children, that’s entirely their prerogative—even if one child has children and another does not.

The argument that someone without children should receive less inheritance is not supported by inheritance law, and would likely be considered invalid or unethical by most estate attorneys unless there is a compelling reason tied to dependency, need, or past contributions.

Toxic Entitlement in Estate Planning

This situation is also a cautionary tale about toxic entitlement in family dynamics. The sister-in-law’s aggressive stance reflects an unfortunately common pattern where in-laws view aging relatives’ estates as future financial security. Psychologists note that this form of anticipatory inheritance behavior can lead to strained family relationships, especially when younger family members feel owed a larger portion due to life choices—like having children (Psychology Today).

Her statement that the family’s history would be “wasted on a dead end” veers into emotional manipulation and reproductive discrimination, implying that only parents are worthy heirs. This is not only an offensive assertion—it fails to consider the long-term consequences of alienating a trustworthy, responsible family member.

Estate Planning Trends Among Modern Families

More and more families today are intentionally choosing child-free executors or trustees—especially those with legal, financial, or administrative backgrounds. As reported by Forbes, many families are selecting executors who are emotionally detached from the inheritance to reduce conflict, especially when large sums are involved (Forbes Source).

Your parents’ decision to select you as trustee was likely a calculated choice, made to protect their estate and minimize internal disputes. Their desire for equitable allocation reflects a modern understanding of fairness, not an outdated notion of legacy based solely on offspring.

People in the comments backed the author, telling that his sister-in-law’s pretentions are completely disregarding and inappropriate at least

Refusing to defer to your sister-in-law’s argument isn’t petty—it’s principled. Her belief that only parents are qualified to carry on a legacy is not supported by legal precedent, financial logic, or ethical inheritance practices. Your parents chose you because they trust you, not because of your reproductive choices. In estate planning, legacy is about more than lineage—it’s about stewardship, responsibility, and respect.