“Is It Fair to Split Car Expenses When Only One Owns the Car?”

Money management in relationships is one of the most common sources of tension between partners. In fact, a 2022 YouGov poll revealed that 28% of Americans in serious relationships argue about finances. Whether it’s decisions about saving, spending, or splitting expenses, poor financial planning for couples can take a serious toll on the relationship.

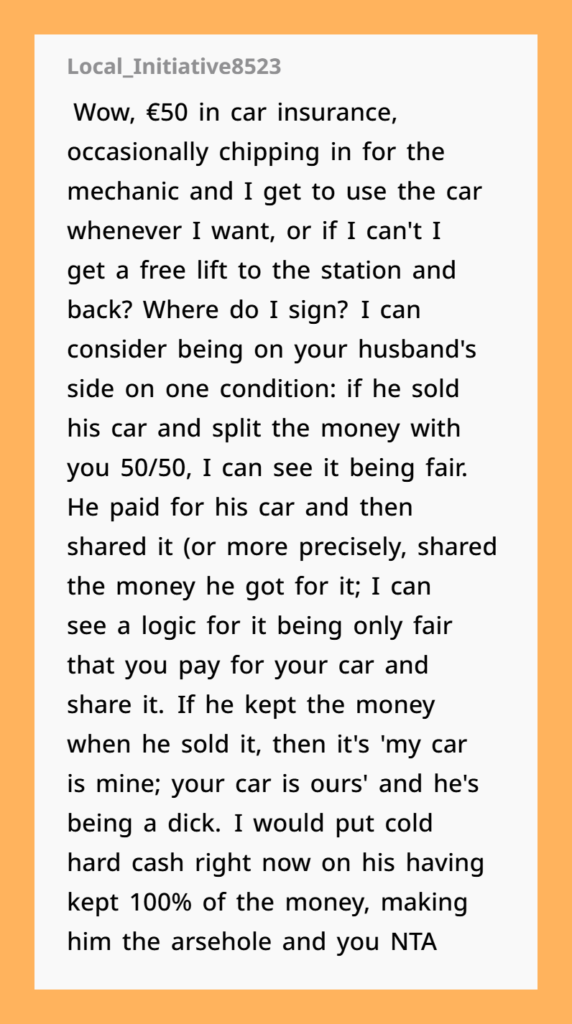

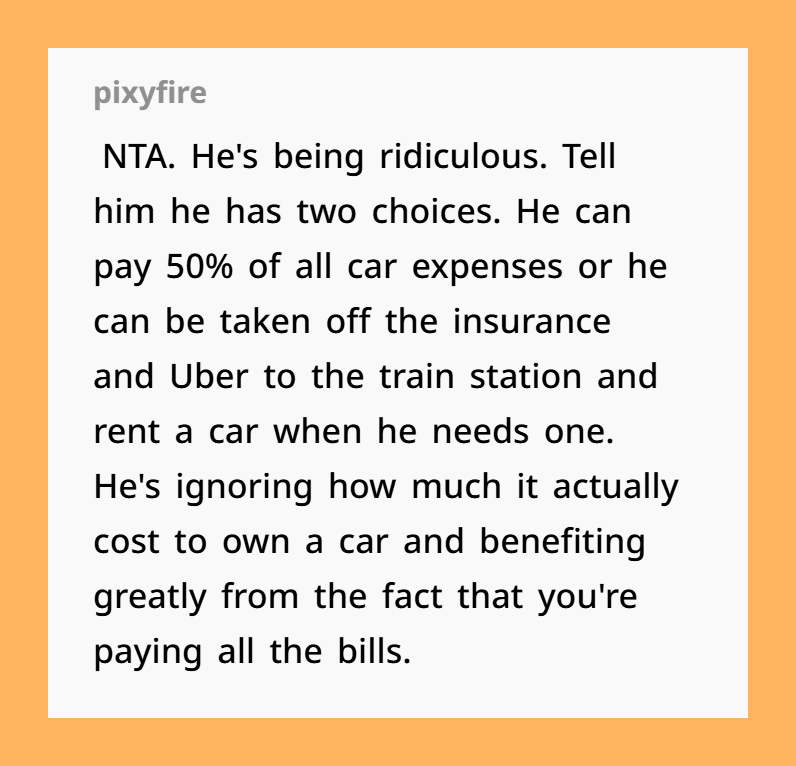

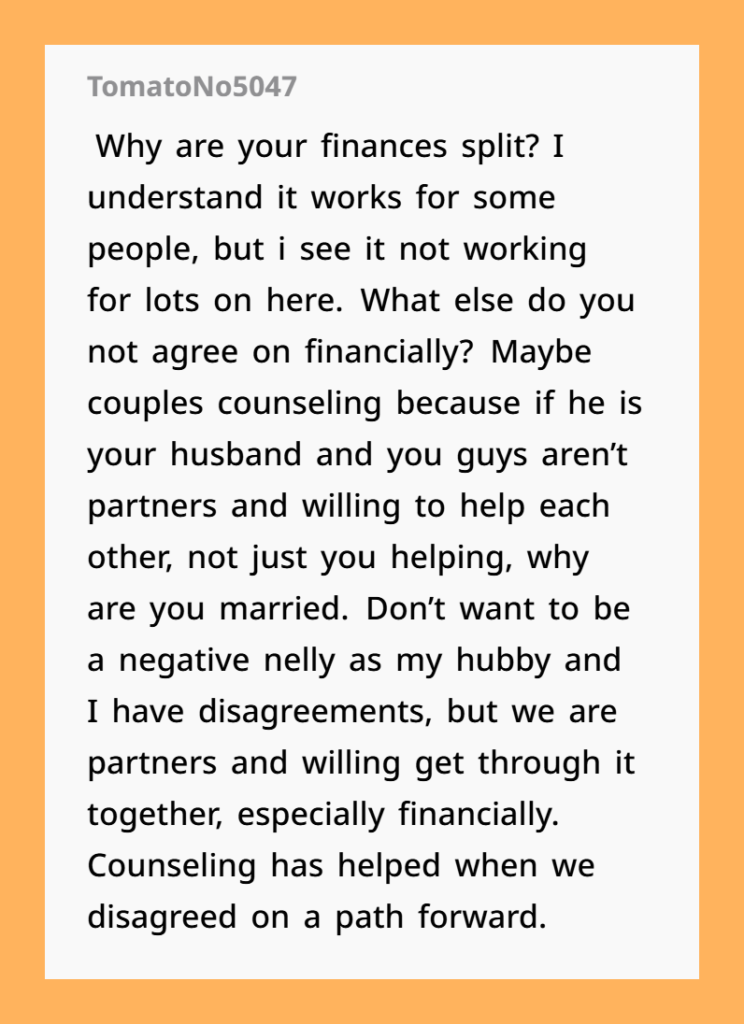

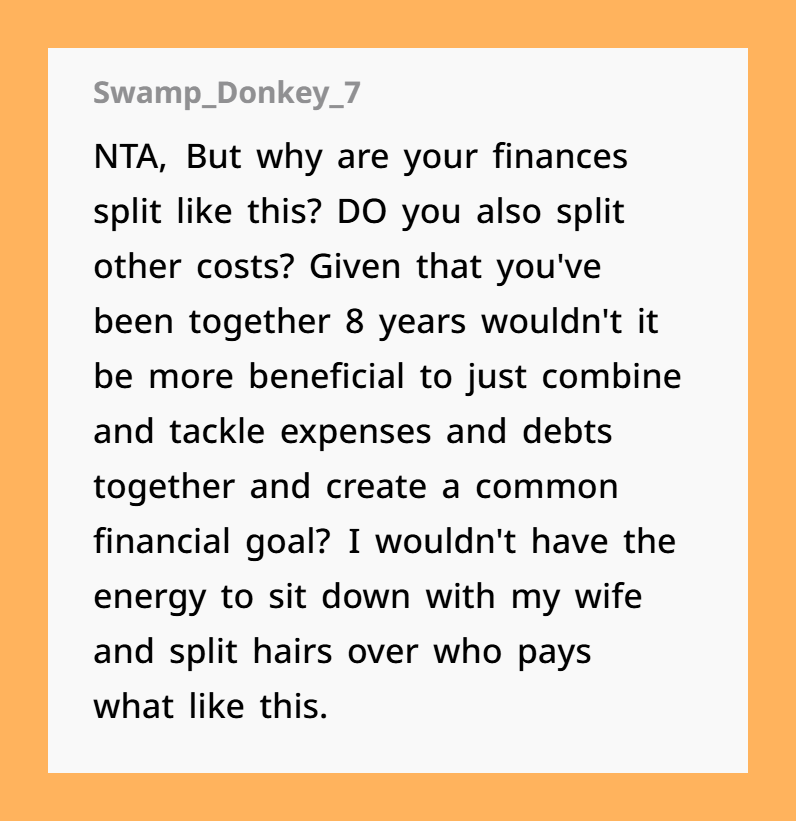

One couple recently found themselves in a heated debate over shared expenses—specifically, car maintenance. The wife believed her husband should help cover the repair costs, since he uses the vehicle frequently. However, the husband felt it was unreasonable, as the car was technically registered under her name. Unsure how to fairly split bills in a relationship, the wife turned to the internet for advice on how to navigate this tricky financial dilemma.

Husband and wife disagreed on paying their car’s mechanical bills 50/50

When there’s only one vehicle in the household, couples can adopt a cost-effective auto sharing strategy that maximizes financial planning and budget optimization. Every family manages their expenses uniquely, and while one partner’s meticulous nature might seem unusual to some, if the couple has a well-structured agreement regarding their shared car expenses, who are outsiders to judge their smart financial planning?

For those seeking a systematic approach, auto finance experts like Attorney Janelle Orsi recommend three potential methods to manage vehicle expense sharing: a fixed monthly fee, a fee based on mileage consumption, or a hybrid model combining both strategies. These methods are designed to streamline auto expense management and deliver cost-effective budgeting solutions.

Calculating fees based on mileage involves more than just tallying up fuel expenses. A savvy approach is to determine the annual vehicle expenses—including fuel, maintenance, and variable costs—and then divide this total by the combined miles driven by each partner. This method ensures that your cost sharing reflects actual usage, making it a highly efficient budgeting strategy.

Alternatively, if the mileage-based calculation seems too complex, couples might opt to split fixed overhead expenses such as insurance, registration, and roadside assistance evenly. The co-user should also contribute to the monthly auto financing payments, though it’s practical not to expect them to cover the full principal. Instead, the idea is to determine an equitable contribution by factoring in the car’s depreciation.

For instance, by comparing your vehicle to a similar model that is a year older, you can estimate the depreciation cost accurately. Suppose you purchased your car for $15k, and a comparable older model with an extra 15,000 miles is priced at $9.8k; this suggests an annual depreciation of around $1.2k. When broken down, that equates to roughly $100 per month, implying that the co-sharer should contribute about $50 monthly towards depreciation. This method is an excellent example of leveraging depreciation calculation techniques for smarter auto expense management.

Maintenance and repair costs, especially for major repairs like brakes, transmissions, or timing belts, should also be considered carefully. It’s essential for both parties to discuss and agree on a fair contribution level for these potentially high-cost repairs, ensuring transparency and mutual financial comfort.

Beyond auto-related expenses, the most equitable approach to overall household budgeting is to allocate costs proportionate to each partner’s earnings. Traditional 50/50 splits can be less practical in households where incomes differ significantly. For example, if the husband earns approximately £45k a year and the wife earns around £30k, a proportional split is advisable. This method aligns with effective personal finance management principles, ensuring that each partner contributes to shared expenses in a manner that reflects their income, thereby promoting financial equity and long-term stability.

By incorporating these advanced financial planning strategies—whether through innovative auto expense management techniques or balanced household budgeting practices—couples can achieve a financially secure and cost-effective lifestyle that supports both partners’ economic well-being while optimizing overall budget performance.

The wife clarified that the couple doesn’t disagree on other money issues and all other expenses are joint