Boss Buys Cybertruck, Then Tells Staff He Can’t Make Payroll

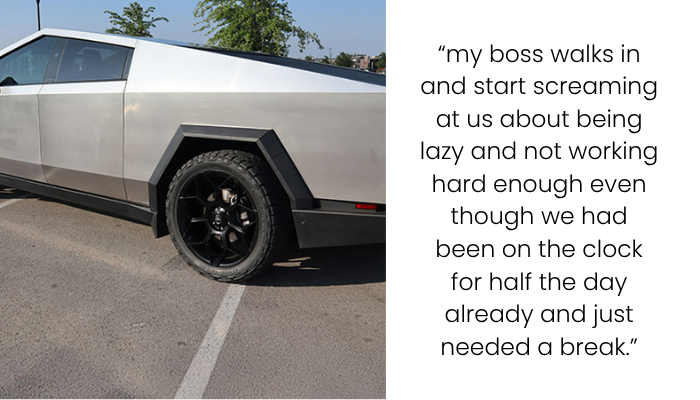

In a moment that epitomizes the disconnect between management and labor, the narrator recounts a surreal encounter with their boss—a small business owner in the construction industry—who berates employees for taking a break, then promptly shows off his brand-new Tesla Cybertruck. The absurdity reaches peak irony when he follows up his extravagant display by announcing he can’t make payroll, blaming “the government” for the delay. The employees, caught between unjust criticism and looming financial uncertainty, are left stunned.

This story is more than just workplace gossip—it’s a snapshot of how performative wealth, misplaced blame, and lack of transparency can severely damage trust and morale. It also underlines a deeper issue: when employees see clear signs of financial irresponsibility at the top, especially during tough times, it exacerbates frustration and fuels resentment. In this case, the juxtaposition of luxury and excuses paints the boss as tone-deaf at best and exploitative at worst.

Cybertrucks are known for their high price tag and are widely considered a luxury vehicle

An employee shared how their boss interrupted a short break just to accuse them of being “lazy”

Labor Law, Ethics, and Financial Mismanagement

This story is more than a meme-worthy moment of managerial tone-deafness—it touches on legal, financial, and ethical dimensions that impact real workers across industries, especially in small businesses where power is often centralized and accountability is minimal.

Legal Ground: Payroll Delay and Worker Rights

In the United States, failing to pay employees on time is a serious violation of federal and state labor laws. The Fair Labor Standards Act (FLSA) mandates timely compensation for all hours worked, and each state has additional wage payment laws. In California, for instance, failure to pay wages promptly can result in waiting time penalties. In New York, it can lead to fines and even civil suits.

If the boss in this story genuinely cannot make payroll, it’s his legal obligation to notify employees, document the cause, and rectify the issue as quickly as possible. More importantly, any financial issues should be transparently communicated—not passed off as a vague “government problem” while flaunting a luxury vehicle worth over $100,000.

Financial Ethics: Asset Purchases vs. Payroll Obligations

From a financial management perspective, payroll is a fixed priority expense—a non-negotiable obligation that should be protected at all costs. When a business owner buys a high-end, non-essential asset like a Cybertruck while claiming they can’t afford payroll, it signals either:

- Poor financial planning, or

- Intentional prioritization of personal wants over professional duties.

In finance, this is known as a liquidity mismatch—using cash reserves for illiquid assets while ignoring operational cash flow needs. It’s a sign of mismanagement, and in some cases, it could even expose the business to embezzlement or fiduciary breach allegations, especially if investor or partner funds were used.

The Politics of Blame: Government vs. Personal Responsibility

The boss’s statement blaming “the government” is a classic deflection tactic, one that avoids personal accountability and shifts responsibility to a convenient scapegoat. While bureaucratic payroll delays can happen—such as tax lien freezes or bank processing errors—they are typically rare, and rarely the real reason small businesses miss payroll.

Instead, blaming external forces—particularly political targets—serves as a dog whistle that attempts to galvanize sympathy or frustration among like-minded employees, while ignoring the owner’s own fiscal choices. It creates a toxic culture where excuses replace solutions, and workers are expected to shoulder the burden.

Workplace Culture and Morale

Seeing an employer live luxuriously while failing to meet basic obligations is demoralizing, especially in physically demanding industries like construction. It undermines employee loyalty, contributes to high turnover, and, if not addressed, often results in unionization efforts or labor complaints.

In sociology, this is part of the “moral economy” of the workplace—unspoken expectations about fairness and decency. When employers break that code, even legally compliant actions can cause widespread dissatisfaction and disengagement.

Many people online believed the author’s boss had no idea how to properly run a business