Man Boasts About Big Profits While Ignoring Debt to Relative, Gets Publicly Confronted

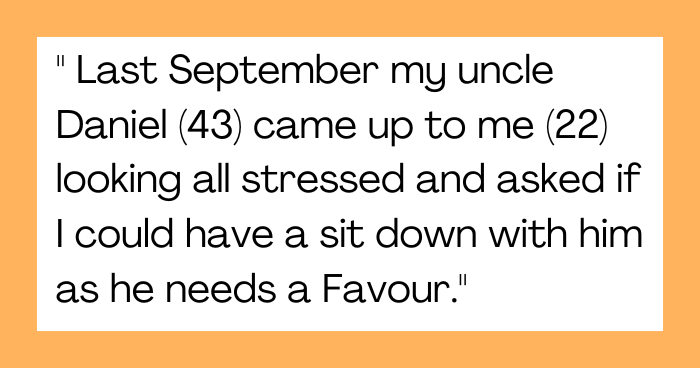

An awkward moment during a family’s Christmas gathering where a 22-year-old confronted their uncle Daniel about a $700 debt. The money had been borrowed by Daniel months earlier in a fake act of limited means for repayment before December. But since that one time, the young lender had literally heard nothing about repayment. In front of his family, including wife Clare and daughter Aisha, Daniel revealed he had booked a surprise holiday for them all to the Maldives as a thank you for Aisha who had been a constant source of strength and support while he recovered from a serious back injury. The announcement led the borrower to confront Daniel’s priorities, and family tensions erupted with accusations of insensitivity.

So when Daniel offered his daughter a hug, it was a nice gesture, but to the people who had just confronted him about keeping his daughter at the sewer, it felt a little bit out of place. Was raising the debt in a celebratory environment appropriate, or did this trigger a confrontation that could have been avoided?

Lending money is always risky, particularly when the recipient is a family member

But one netizen ended up causing a scene when their uncle booked a Maldives trip instead of returning $700

Financial Etiquette, Debt Repayment, and Family Dynamics

The Ethics of Borrowing and Repayment

Taking a Loan from Friends & Family Makes the Equation Intricate Iguana-Moving Trust Qubicle To guard against ambiguities, experts suggest defining repayment parameters. In this case, if Daniel had failed to keep the agreed deadline or communicated delays, he would be breaching these principles. A CNBC survey revealed about half of the people who loaned family or friends money never saw it again, straining relationships.-Saharanpur, Thaturu news makers. However, transparent discussions about repayment schedules and financial priorities can avoid this sort of trouble.

Legal and Moral Considerations

Although informal loans between family members may not be documented, they can be legally binding in certain jurisdictions if specified. Here a mere oral agreement between lender and borrower might be binding. If the lender wanted to take the borrower to small claims court, there could be an avenue for relief — and an even bigger AK-47 round hole blasted through the middle of the family. Even when lending to family, it may be a good idea to put together a record of the agreement, as outlined in Nolo’s guide on informal loans.

The Role of Timing in Confrontations

Although it is perfectly understandable that the lender would be furious, one has to wonder whether this is a good moment in which to confront someone and whether confronting someone at all is considered good social form in the holidays. Psychology Today lists timing and delivery as vital in conflict resolution. Bringing up things that bother you in a private place makes for a better conversation while sparing everyone from any embarrassment (and/or an escalation). That the confrontation became public probably explains the family’s violent reaction.

Balancing Family Support and Financial Boundaries

Sometimes during seasons of need, people feel bad to not help because it is family. But lending money should not be to the detriment of the lender, financially or emotionally. Forbes suggests establishing boundaries with financial help to safeguard relationships. Is anyone seriously arguing that providing support should free borrowers from accountability (or consequence)? Daniel, on the other hand, should be questioned about his priorities as he chose a luxury vacation over his obligation to pay rent.

Lessons Learned for Both Parties

This scenario offers a few lessons for both lender and borrower. The lender can practice financial boundaries and determine when they should be part of the conversation without damaging relationships. For the loaners, if the borrower respects the repayment obligation or reports the issues encountered in loan repayment honestly it can eliminate misundersetanding. As financial adviser Suze Orman always said, “People before money before things” — and that should inform the balancing act between family and the financial demands of life.

Many thought the uncle was out of line