AITA for Refusing to Pay My Parents’ Mortgage After They Stole Money From My Savings?

An 18 year old hard-working girl is entangled in an appalling betrayal. Bernadette had worked hard to save from her job for over a year, only for her parents, in need of cash, to casually withdraw $990 from her savings account without her consent. Her father belittled her, even demanding she courier him more money the following day. When she said no, her mother labeled her selfish, claiming “your money is our money,” and proceeded to rationalize her behavior by noting the house would one day belong to her daughter anyway.

Torn between keeping the peace at home and defending her hard-earned cash, she wonders whether doing the right thing just makes her a selfish b*tch. It touches on the intricacies of family, money, and emotional blackmail—making her wonder if not giving in was the best thing to do.

Financial Boundaries, Parental Responsibility, and Emotional Manipulation

1. Establishing Financial Boundaries in Families

Financial dynamics between families must shift when the children still live at home begin to earn their money. Still, parents ought to observe borders where proper, notably round the financial affairs of their offspring. The money belong to the child, not the parent, irrespective of how much support they have given over the years, so legally and ethically there is no reason why a parent can claim any of it.

In this instance, the parents did something terribly wrong by stealing money. Violating financial boundaries violates thresholds of trust, and trust is a key component of any healthy relationship. Forbes reported experts that indicated clear boundaries regarding finances are essential in families, as otherwise, people get emotionally exhausted and will hold grudges, especially when it involves living together or financial pressure.

2. The “You Owe Us” Guilt Trap

The mother tries to guilt the daughter into submission by accusing her of being “selfish and ungrateful” because she notes they helped her in the past — a passive-aggressive trap that is often employed in codependent dynamics. Even if parents give up their lives for their child to develop the best of its potential maturity, such support does not automatically lead to a claim on the child’s future income map.

This sort of logic can be a form of emotional abuse. It cheapens that sense of agency and effort in the child, at the same time reinforcing the notion that they must repay their parents for doing nothing more than performing basic parental obligations. But, as we write in Psychology Today, these guilt traps foster a relationship dynamic in which monetary and emotional exploitation is the norm.

3. The Impact of Financial Abuse and Control

Stealing money, but especially forcibly or insidiously, is financial abuse. This kind of toxic behavior is found to occur in toxic or dysfunctional family dynamics and manifests when it affects adults, and more so young adults who still rely on their parents for shelter or support.

Victims of financial abuse are robbed of autonomy and left feeling that they have little choice or that they are in some way indebted to those who control their finances. Here, the controlling behavior of the parents — stealing from her account and demanding even more. In downplaying her financial autonomy, they threaten her future stability.

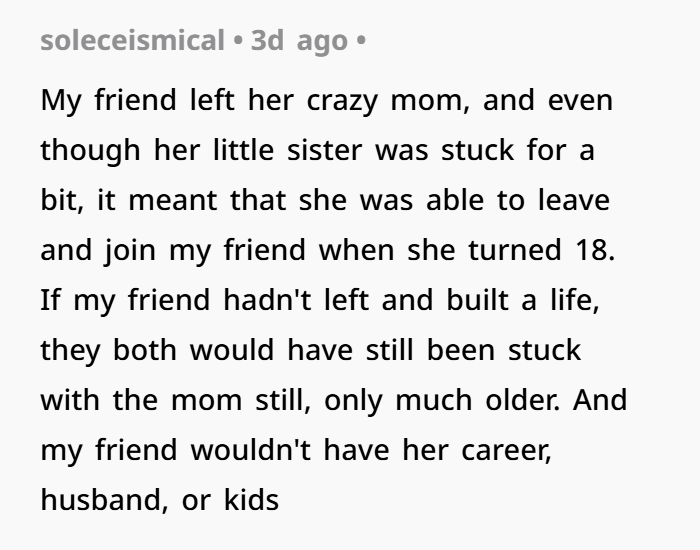

4. Prioritizing Financial Security Over Family Peace

Even though a refusal to increase the amount might lead to a temporary struggle, it is still the right thing to do to save her own future and the future of her younger sibling. With her financial independence, she can be liberated from this toxic situation and build an authentic life for herself and her brother.

And she was right to point out that helping her parents through a financial crisis doesn’t mean she has to deplete her savings. If she wanted to help someday, it would be without strings, with full disclosure and informed consent, and an expectation of reciprocation or joint liability.

5. Practical Steps to Protect Financial Assets

It is a smart move for the daughter to call her bank and put a stop payment on the funds being transferred, which is also a strong move to protect her savings. There are further measures she can employ:

- Open a Separate Account: Ensure her primary savings are in a bank her parents can’t access, even indirectly.

- Explore Legal Options (Without Immediate Action): While she may not feel ready to file a police report, understanding her rights can empower her to take action if needed in the future.

- Establish an Emergency Fund: Set aside small amounts of cash for urgent expenses in case her access to funds is compromised again.

- Seek Support from Trusted Adults or Friends: Discussing the situation with a mentor, family member, or therapist can provide clarity and emotional support.

As her story went viral, the teenager joined the discussion in the comments

It may seem selfish for the daughter to stop providing financial assistance but it is really a form of self-preservation. So her parents have no respect for her autonomy, and even less respect for her financial boundaries, and she is right to say so. By safeguarding her nest-egg and opting to keep her future from becoming tied to his future; she is is walking away from unhealthy, controlling patterns and wanting for both herself and her sibling a more stable future.